Let Quest handle your Vendor Finance

The perfect solution for buyers and sellers

Perfect solution for

buyers and sellers

Business is slow to sell?

Solution

Quest works with sellers and buyers to facilitate the vendor finance

Seller is nervous about Vendor finance?

Solution

Quest is a finance company. We administer the whole process

Seller doesn’t want to spend the money on lawyers?

Solution

Quest will take care of the finance contracts & legals

Seller is worried about the buyer not making payments?

Solution

We will take care of collections and legals if buyer doesn’t pay

How it works

-

Finding it hard to convince sellers to accept Vendor Finance?

-

Did you wish there was a finance company that can administer the vendor finance?

-

Want to increase your income and do more deals?

Sell Faster, Earn More, and Rest Easy with Quest

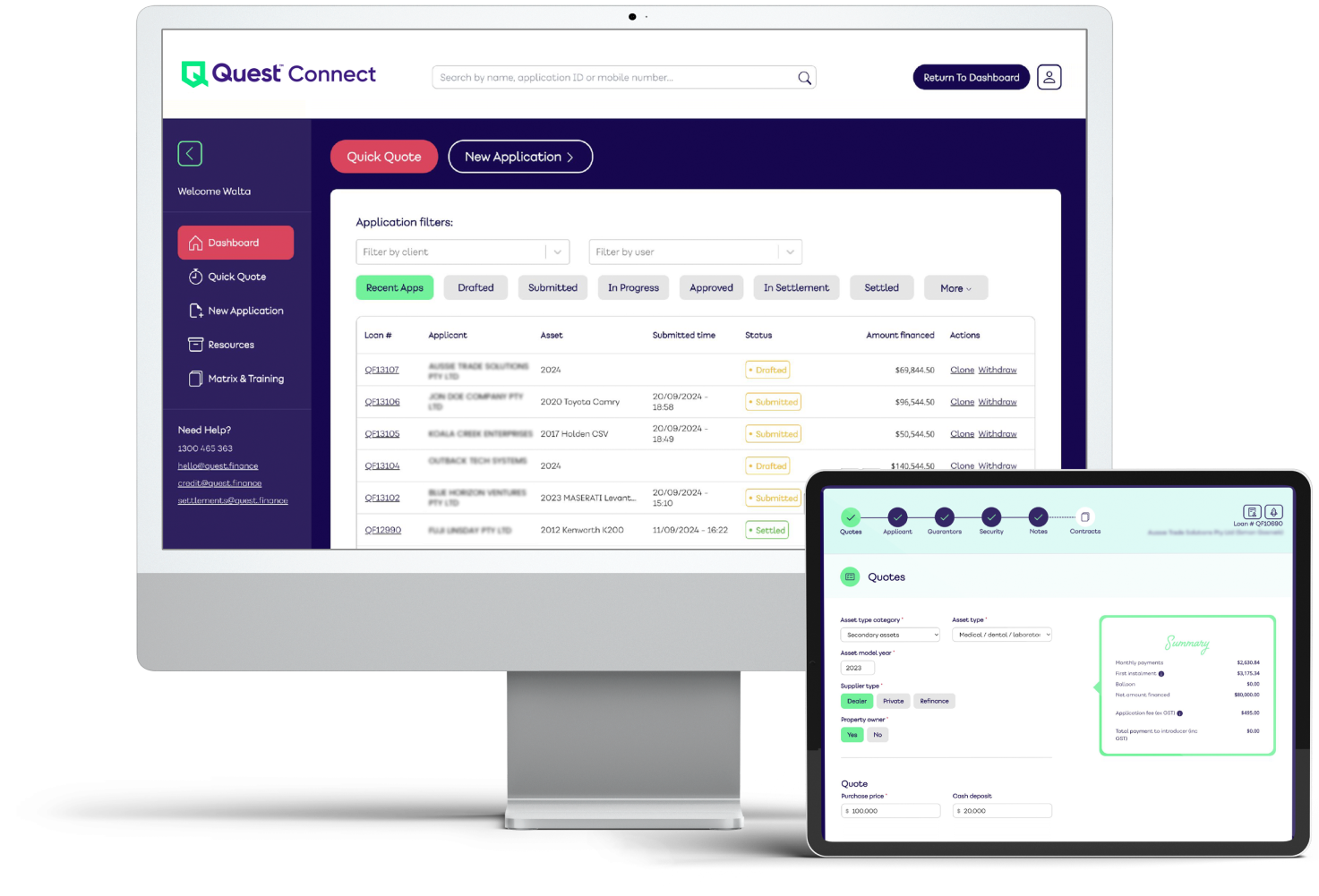

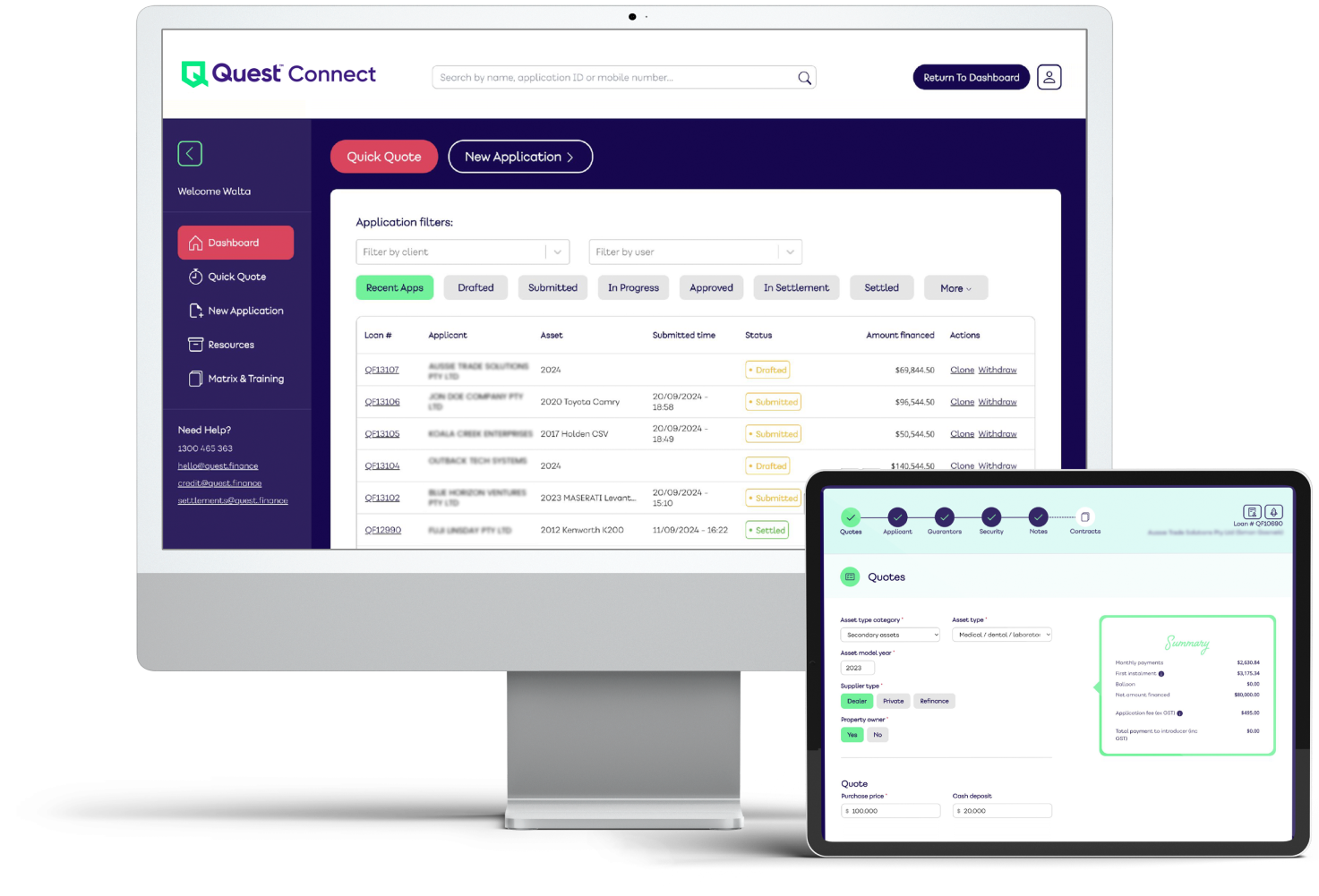

How Quest Works for You?

-

Introduce vendor finance to your clients.

-

We handle the rest: credit checks, loan agreements, payment collection.

-

You close the deal and earn your full commission.

Why Your Vendors Will Love Quest?

-

Faster sales at full price

-

Peace of mind with finance company oversight

-

They earn interest income on financed amount

-

We handle the whole process at no cost to them

-

Protection against late or missed payments