Fund your own loans we handle everything else

We’ve processed over $50M of Loans

Australia’s first outsourced lending Platform for Business loans

-

$50,000,000 plus processed on platform

-

Hundreds of Funders outsource their lending to Quest

-

You fund 100% of the loan or we Co-Fund together

How it works

1. Quote

You quote & submit application in Quest portal. Asset finance and Business loans.

2. Choose rate

You choose the interest rate and fees you want to charge.

3. Assess

Quest will assist with assessing the loan and carry out all credit checks, AML and PPSR.

4. Settle & manage

Quest handles full loan administration and customer payments.

5. Collect income

You get paid principal and interest every month.

Who we serve

Finance Brokers

Join over 430 brokers already using Quest's platform to fund their own loans

Equipment Suppliers

Lend from your own balance sheet to increase your profit margins and convert more sales

How Quest Helps You

Credit

Our credit engine collects many data points so we work with you to highlight any red flags

Compliance

We ensure that the finance contracts comply including AML, AUSTRAC and PPSR registrations

Collections

We handle all collections. Our contracts give us powers to place a caveat on the borrower's property in an event of a default

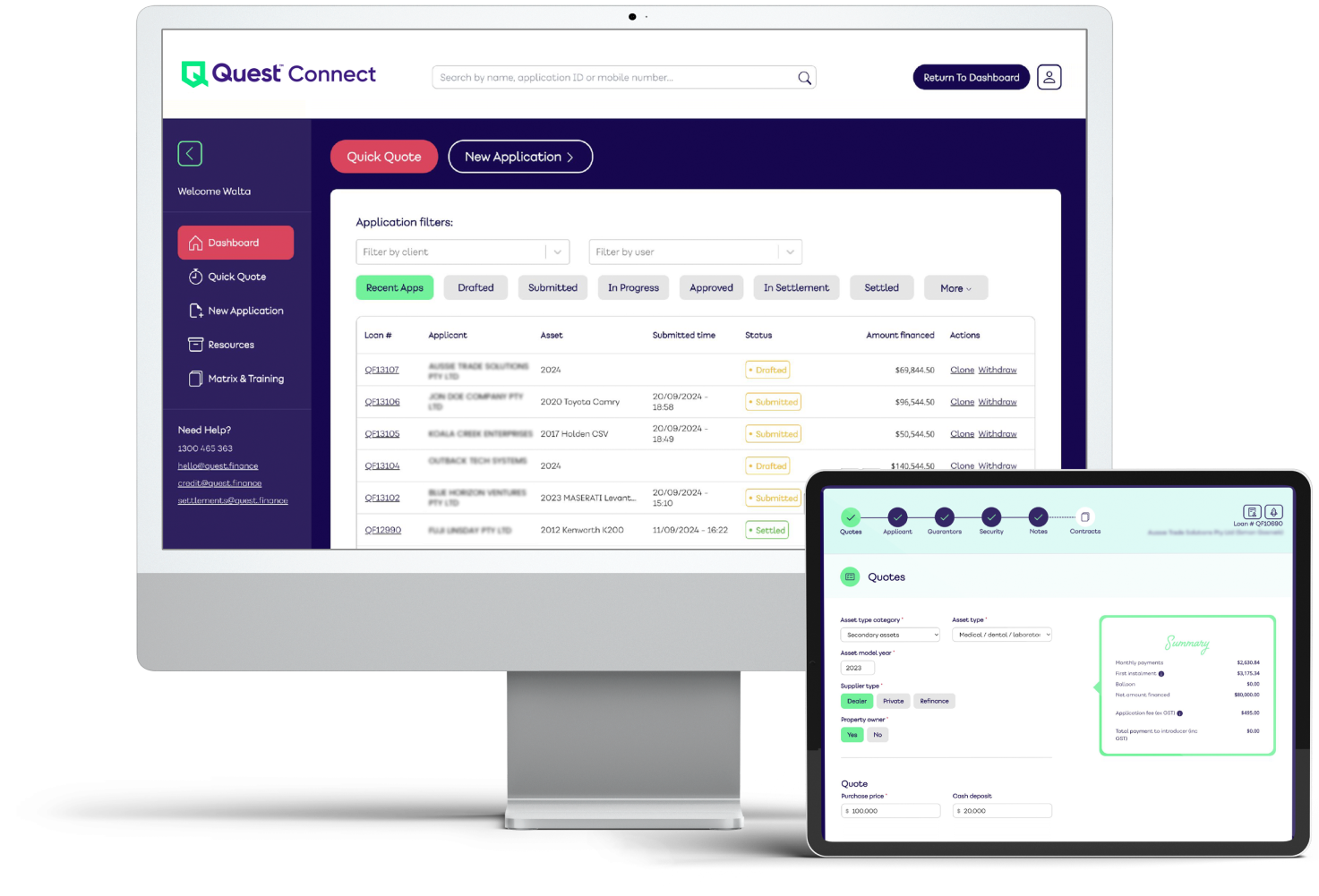

Quest iQ

Cloud based origination and lending platform

Intuitive loan origination platform

Credit decisioning platform with full API integration to multiple data providers

Automated credit tasks with full audit trail. Reducing manual errors by 98%

Built in security and compliance

Backed by Global VC with Trustee Oversight

Over $50 million of loans funded on our platform

We're backed by ICM Limited. A global Venture Capital firm

Monthly audits of trust accounts by AMAL Trustees. Less than 1% loss and minimal arrears

Why lend your own money?

More value

Build your own loan book. It's for customers that don't fit a particular lender but are a good credit risk

More income

Potential to increase income per deal from 4% to 44% !*