Lend your own money using Quest’s end to end platform

See how Hai Truong turned 4% brokerage into 44% return on capital

Hai Truong

(Broker) Dealer Finance Group

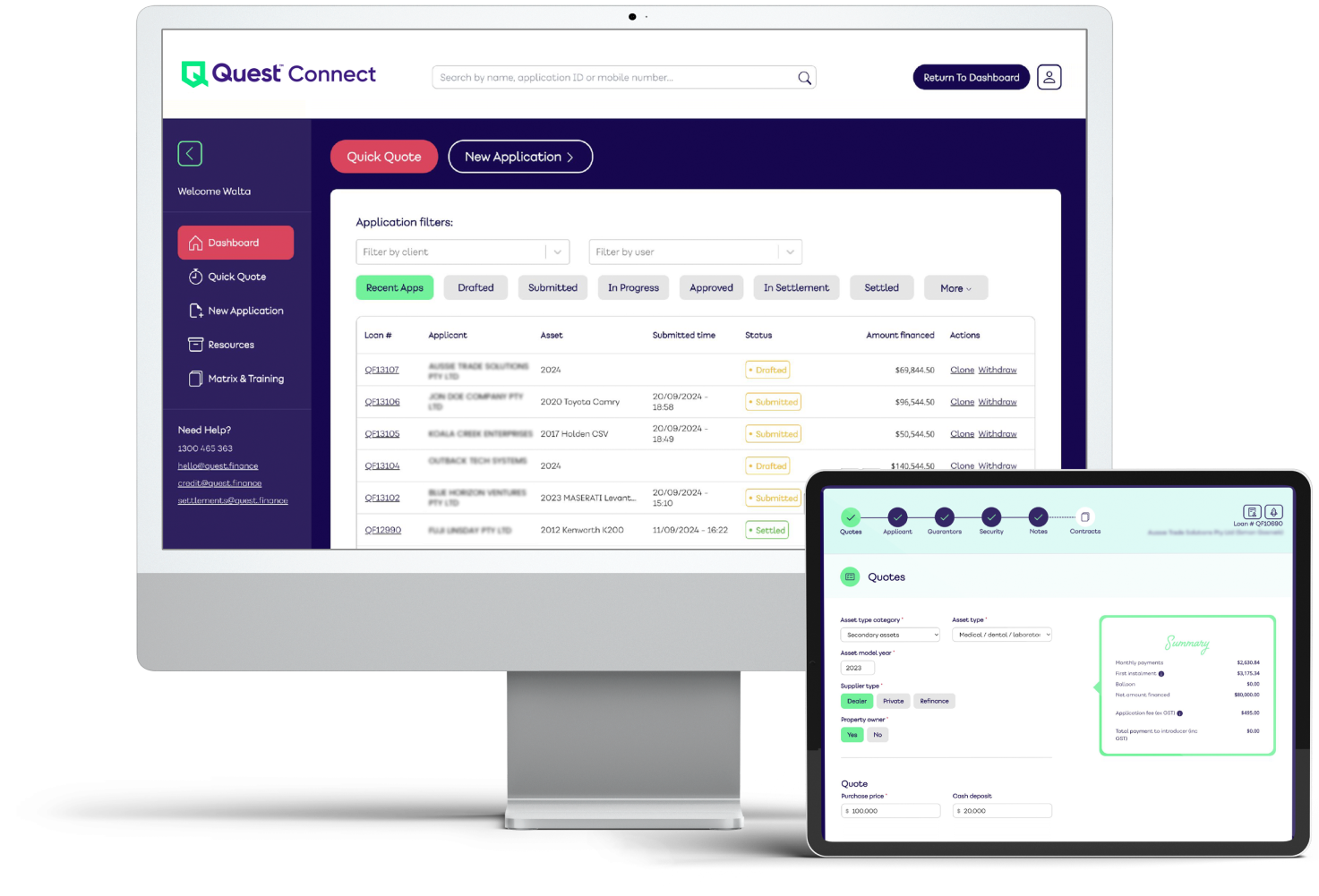

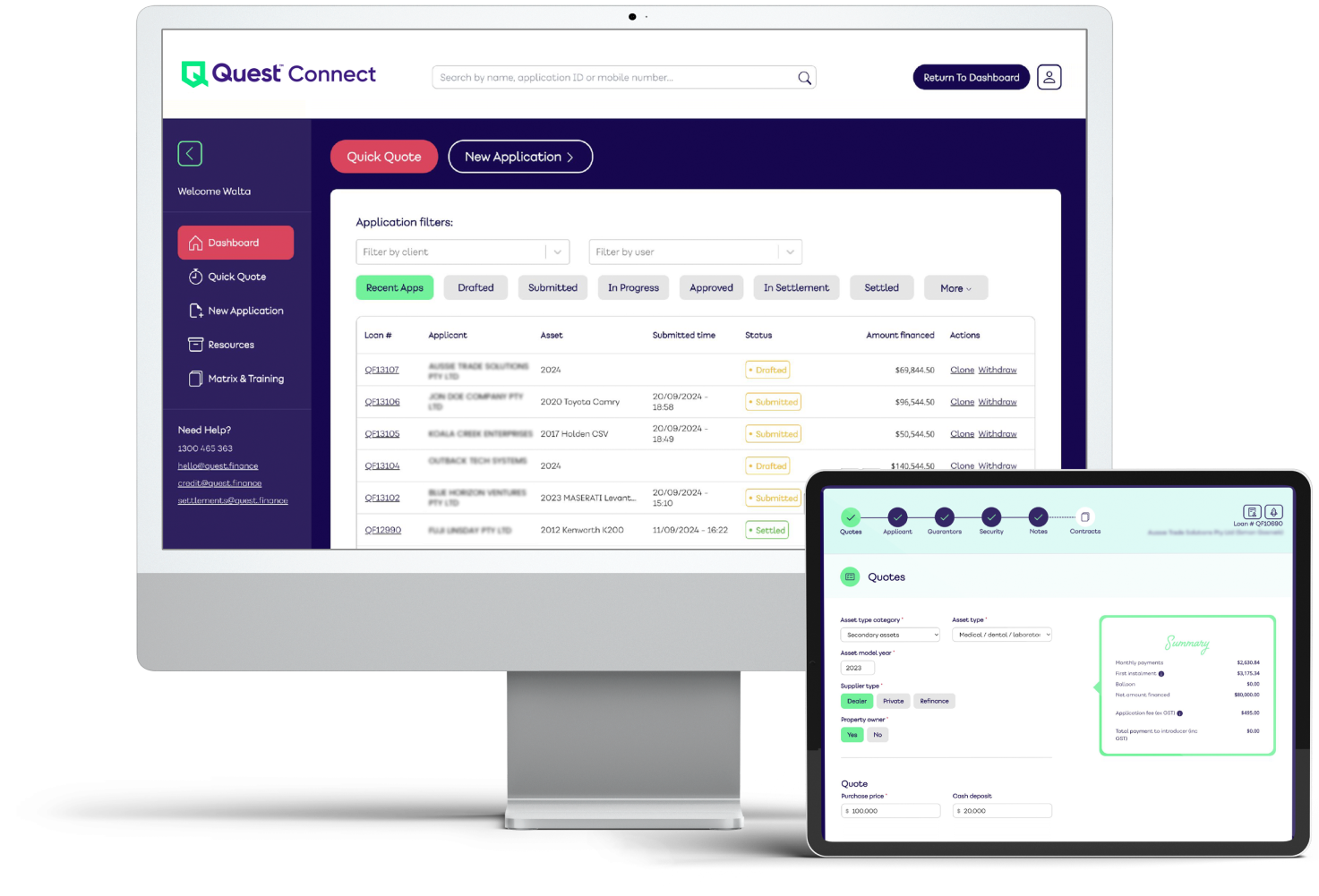

How it works

1. Quote

You quote & submit application in Quest portal. Asset finance and Business loans.

2. Choose rate

You choose the interest rate and fees you want to charge.

3. Assess

Quest will assist with assessing the loan and carry out all credit checks, AML and PPSR.

4. Settle & manage

Quest handles full loan administration and customer payments.

5. Collect income

You get paid principal and interest every month.

How Quest Helps You

Credit

Our credit engine collects many data points so we work with you to highlight any red flags

Compliance

We ensure that the finance contracts comply including AML, AUSTRAC and PPSR registrations

Collections

We handle all collections. Our contracts give us powers to place a caveat on the borrower's property in an event of a default

Example $50k asset at 16.99 base rate

* This example assumes $52,000 loan for a ABN holder purchasing an asset for predominant business use. The loan term is 5-years, nil balloon, 16.99% base rate, 4% brokerage ex GST. Payments are assumed to be made monthly with the Application Fee paid upfront.

Why lend your own money?

More value

Build your own loan book. It's for customers that don't fit a particular lender but are a good credit risk

More income

Potential to increase income per deal from 4% to 44% !*

More control

Get an unfair advantage by becoming your own lender whilst Quest does the heavy lifting.

Lending Scenarios

Funded by Brokers and Suppliers

Client

Service Station

The owner of a service station, located in Brisbane, required $55k for a fit out to build a section for hot food

Time in business

4 Years

Asset backed

Home buyer with $800K in Equity

Terms of loan

$55K / 2 Years / 17% Base rate

Security

2020 Toyota Prado / $75K value

Income

Brokerage: $3K / Interest: $7700 / ROC: 18%

Client

Truck Driver

Two directors, both asset backed with a growing business and good repayments history. Company credit score is 400 due to credit enquiries.

Time in business

3.5 Years

Asset backed

Home buyer with $2.2M in Equity

Terms of loan

$110,000 / 4 Years / 17.50% Base rate

Security

2017 Kenworth Truck / $140K value

Income

Brokerage: $5K / Interest: $36,117 / ROC: 35%

Backed by Global VC with Trustee Oversight

Over $50 million of loans funded on our platform

We're backed by ICM Limited. A global Venture Capital firm