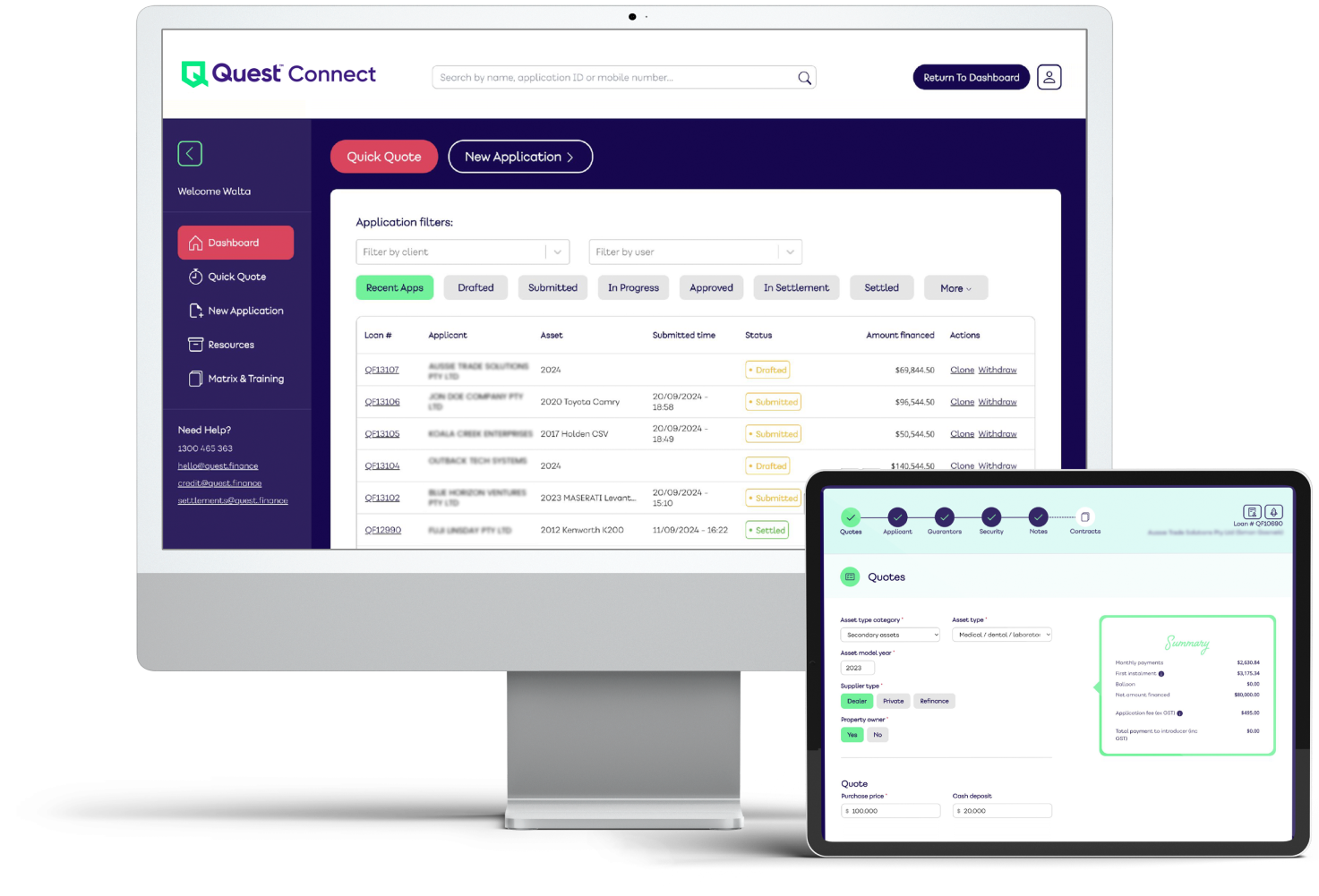

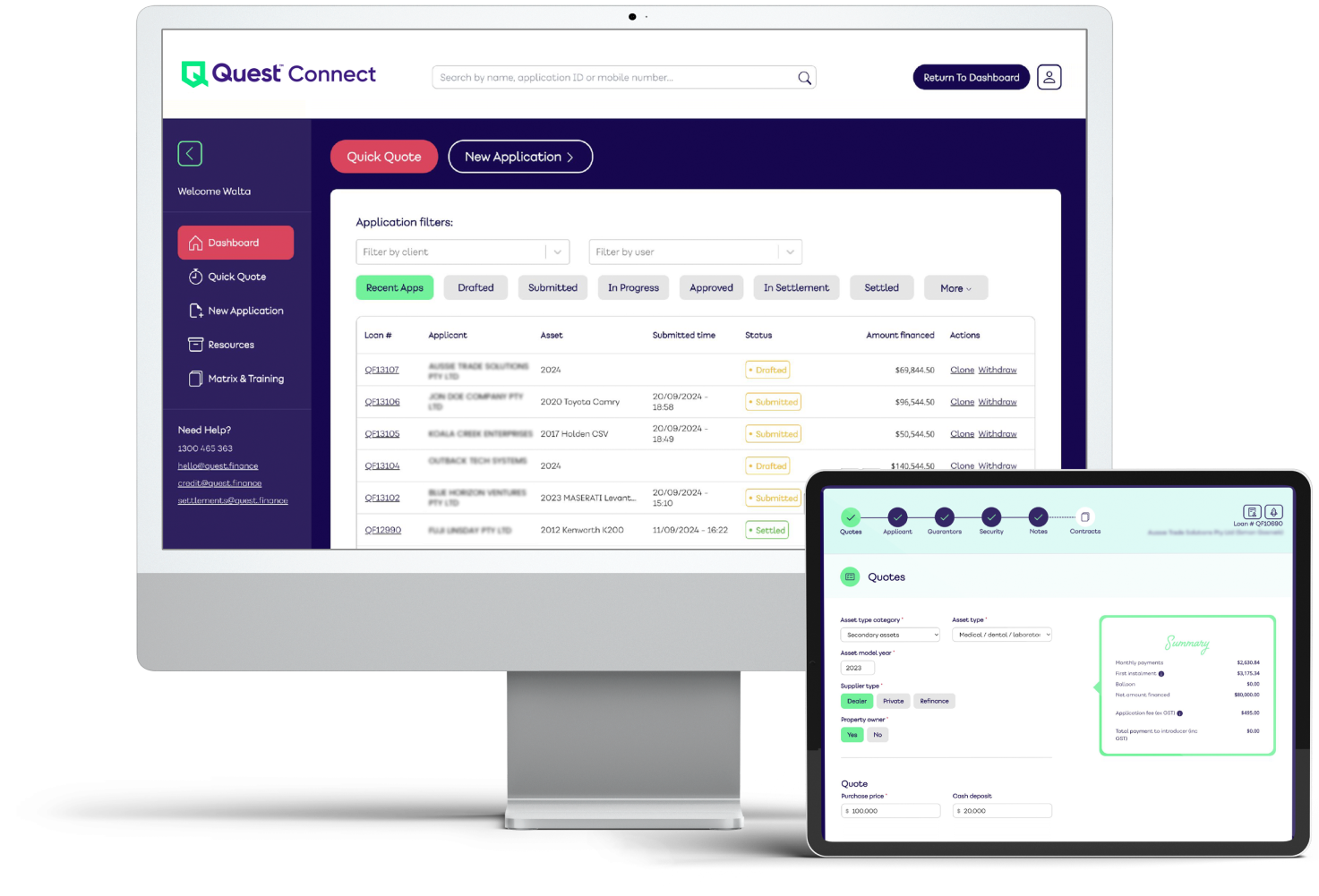

Lend your own money using Quest’s end to end platform

How it works

You fund loan, we handle everything else.

1. Quote

You quote & submit application in Quest portal. Asset finance and Business loans.

2. Choose rate

You choose the interest rate and fees you want to charge.

3. Assess

Quest will assist with assessing the loan and carry out all credit checks, AML and PPSR.

4. Settle & manage

Quest handles full loan administration and customer payments.

5. Collect income

You get paid principal and interest every month.

How Quest Helps You

Credit

Our credit engine collects many data points so we work with you to highlight any red flags

Compliance

We ensure that the finance contracts comply including AML, AUSTRAC and PPSR registrations

Collections

We handle all collections. Our contracts give us powers to place a caveat on the borrower's property in an event of a default

-

Are you currently lending your own money to businesses?

-

You don’t want your client to know that you are lending to them?

-

Are you tired of all the work required to administer your loans?

Why lend your own money?

More value

Added value to your clients who require urgent funding but don't qualify with mainstream lenders.

More income

Earn more income whilst you also help your clients.

More control

Get an unfair advantage by becoming your own lender whilst Quest does the heavy lifting.

Backed by Global VC with Trustee Oversight

Over $50 million of loans funded on our platform

We're backed by ICM Limited. A global Venture Capital firm